- Quicken home and business 2016 download and payroll how to#

- Quicken home and business 2016 download and payroll password#

(1) Confirm your payroll by reviewing the check and payroll totals for your hours and earnings. All rights reserved.Ĥ Review and Submit Payroll Once you finish entering your payroll, click Review Payroll. Getting Started with Paychex Online Payroll 2012 Paychex, Inc. Click Void a Check (7) to void a previously issued check. Click Add a Check (6) to enter a regular, manual, or calculate a gross-to-net or net-to-gross check. Use the following features as needed: Click Edit (5) or use Individual Pay View to make one-time overrides to a check s earnings, deductions, or withholdings.

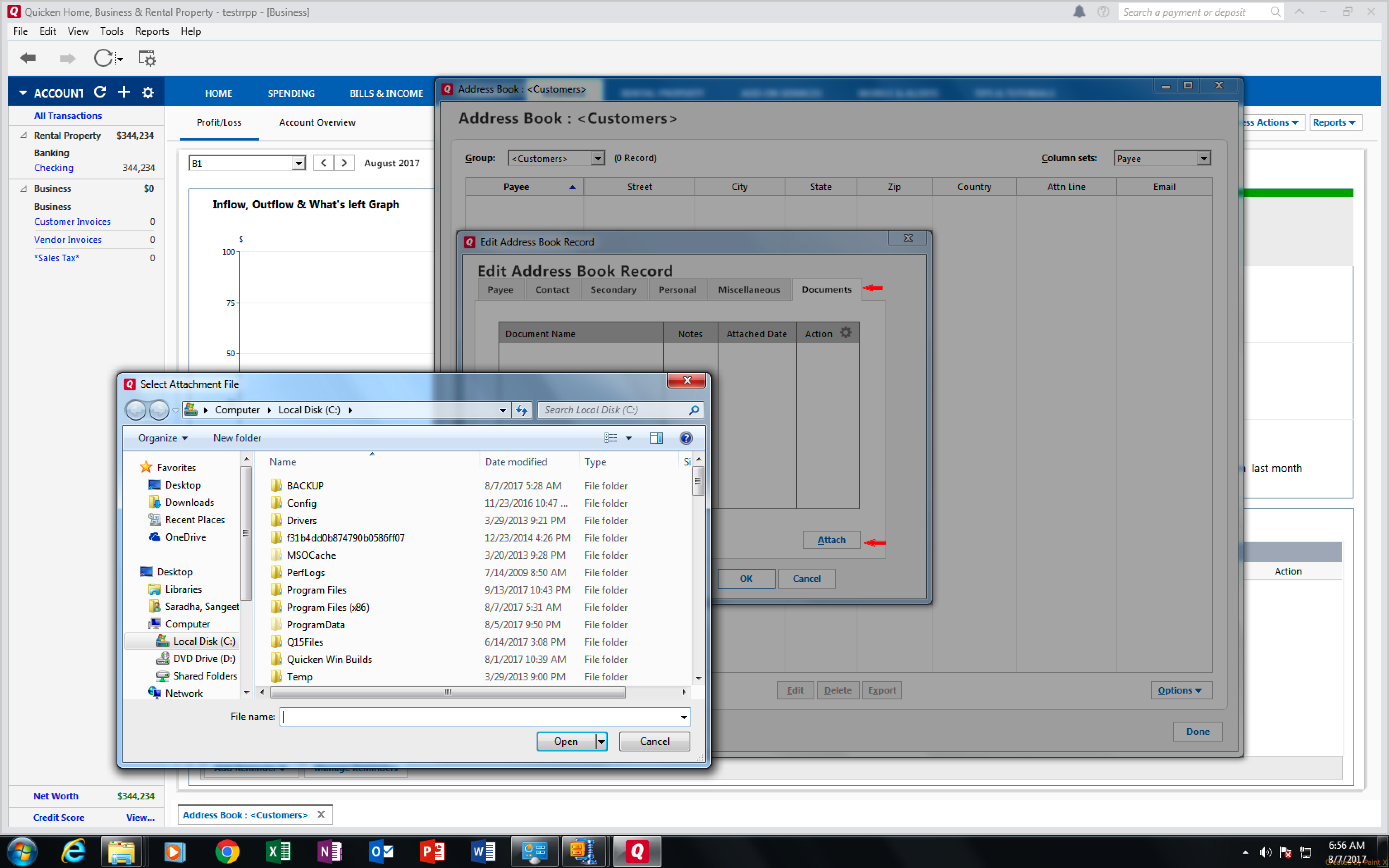

Enter the employee s hours or pay amounts. You can also click All to pay all workers in the Multiple Pay View screen, instead of checking each individual employee. Select the checkbox (4) to create a check for the employee. Begin entering payroll or select another check date. The check date defaults to your next regularly scheduled pay period. Standard hours, rates, and salaries must be preloaded in Employee Maintenenace. (3) You can also take a shortcut and click Automatically Create and Review Payroll to pay all your employees with standard hours and salaries. Select Payroll and select Multiple or Individual Pay View to enter payroll. Enter new employee and contractor information or employee changes. Enter your PIN and click the Payroll service icon.

Quicken home and business 2016 download and payroll password#

Enter your Paychex Online username and password (1) and click Log-In. Verify your payroll processing date, especially when there is a holiday. Company bank changes must be reported to Paychex at least 2 business days before your payroll reporting date. Contact your Paychex representative with any company maintenance changes. 2ģ Getting Started with Paychex Online Payroll Prepare Payroll and Login Before you begin payroll, make sure to do the following: 1. Common Tasks Reference Guide - Paychex Online Payroll Tutorial 2011 Paychex, Inc. Live Training Sessions (4) If you would like additional training, register for a live Online Payroll WebEx session facilitated by a Paychex trainer. Release Notes (3) Refer to the Release Notes section for more information on updates or enhancements to the application. Resources (2) Refer to the Resources section to view the individual documents in this guide. There is also a 20-minute recorded training session, which gives an overview of the application. 1Ģ OTHER ONLINE PAYROLL TRAINING Tutorials (1) Each training topic will walk you through a different area of the application.

Quicken home and business 2016 download and payroll how to#

Managing Employee Access - Learn how to use the Manage Employee Access Online screen from the People services icon in to control employee access to personal and payroll information, check stubs, and copies of Forms W-2. Getting Started with Online Reports - Learn how to view and download payroll reports, tax returns, and invoices with the Paychex Online Reports product. Distributing Hours and Earnings in Pay Entry - Find out how to use Multiple and Individual Pay View to distribute an employee s hours or earnings to different organization units or departments.

Using Check Templates - Do you regularly cut checks with specific earning, deduction, and withholding settings? This job aid will help you create check templates with specific attributes once you won t have to remember to select those settings each time you cut that check. This includes one-time changes to earnings, deductions, and withholdings. Using the Edit Option - Use the Edit option to make one-time only changes to an employee s check during Payroll Entry. This may include checks you wrote in-house or using the Gross to Net or Net to Gross options to calculate a hypothetical check. Creating Additional Checks - Learn how to use the Add a Check Option in Payroll Entry to create additional checks for your employees. Customizing Your Payroll - Check out how to use application Preferences to customize the Payroll Entry screens to match how you normally record and enter your payroll in Online Payroll. Contact Paychex for Company Changes - Learn more about working with your local Paychex representative to assist you with any company maintenance changes or special checks for your payroll.

Payroll in 4 Easy Steps - A more detailed look at the four steps to processing payroll: preparation, beginning a new payroll, entering the data, and reviewing and submitting the payroll to Paychex for processing. TABLE OF CONTENTS Getting Started with Paychex Online Payroll - A 2-page reference to help you log in to the Online Payroll application for the first time and walk you through running your first payroll. 1 Paychex Online Payroll Common Tasks Reference Guide ABOUT THIS GUIDE Use these resources in conjunction with the Paychex Online Payroll Training site, which is available when you log in to Select the Payroll service icon and click Learn More from the bottom of the screen.

0 kommentar(er)

0 kommentar(er)